Direct Auto Insurance Review: Rates & Coverage

Direct Auto Insurance Review: Rates & Coverage

Direct Auto specializes in covering "high-risk" drivers. The company advertises its willingness to work with drivers with issues on their records, such as a history of accidents or driving while intoxicated. This means the company offers SR-22 coverage, which you might need to get your license back.

If you want minimum liability coverage, you can find cheaper-than-average rates with Direct Auto car insurance (formerly known as Direct General), but it gets more expensive as you add to your coverage. Direct Auto insurance operates online and through local agencies. Coverage is available in 16 states.

Pros and cons

Pros

Insures high-risk drivers

Offers SR-22 insurance

Lots of discounts

Cons

Poor customer service

Expensive full coverage car insurance

Few coverage options

Direct Auto Insurance rates

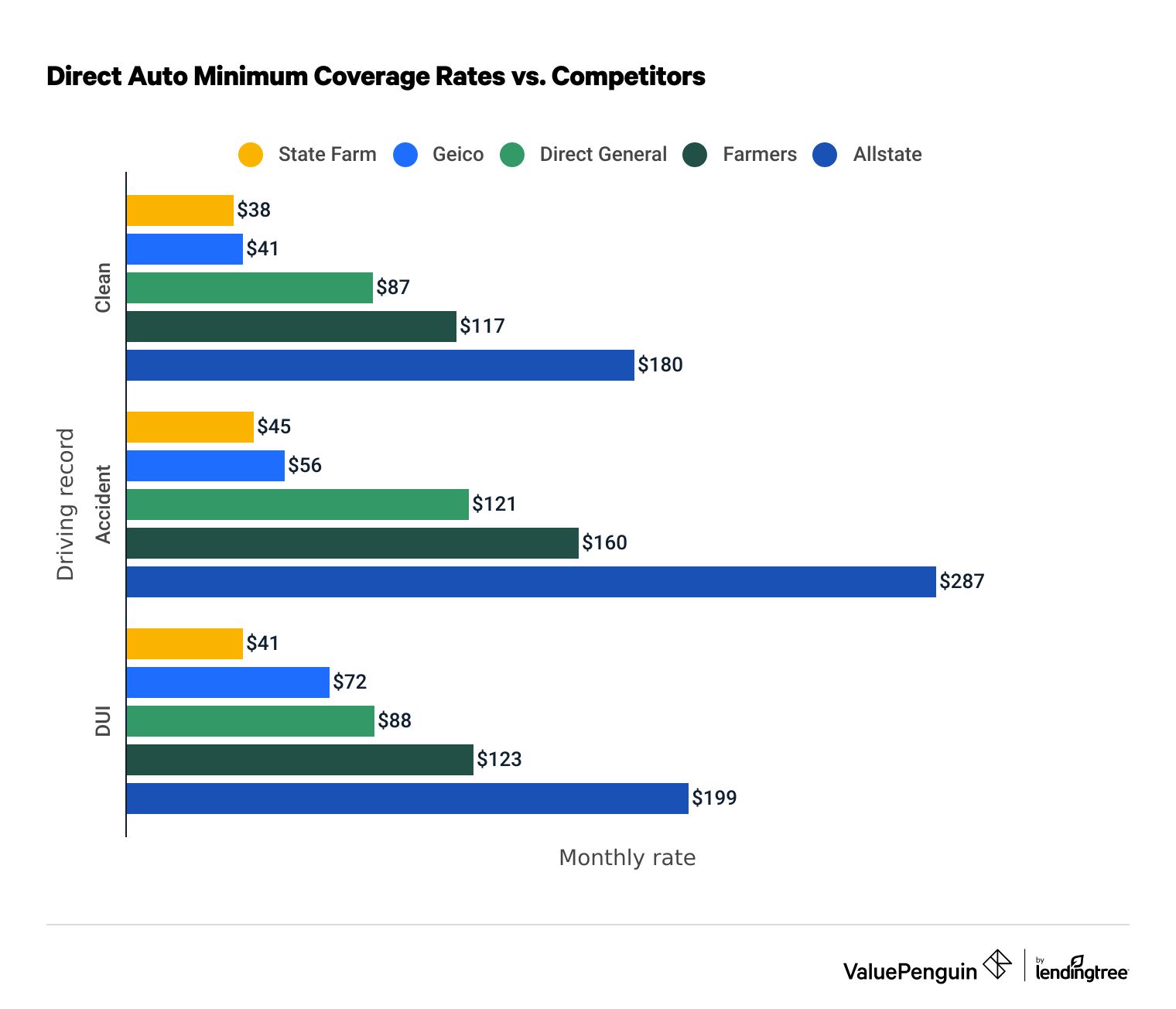

Direct Auto car insurance is a good, affordable company for policies that meet the lowest requirements to legally drive, usually called minimum coverage. However, Direct Auto becomes a more expensive option, if you buy full-coverage car insurance.

That holds true if you have an accident or a DUI. You can get cheaper-than-average rates, especially after a DUI, as long as you stick with minimum coverage.

Minimum coverage

Full coverage

Direct auto monthly rates by driving record

Clean Record

Accident

DUI

Company | Minimum coverage | Full coverage | |

|---|---|---|---|

| State Farm | $38 | $127 |

| Geico | $41 | $169 |

| Travelers | $59 | $193 |

| Direct Auto | $87 | $326 |

| Farmers | $117 | $389 |

| Progressive | $125 | $292 |

| Allstate | $180 | $410 |

Direct Auto Insurance coverage

Direct Auto offers several common add-on coverages, in addition to basic coverage like liability, comprehensive, collision and personal injury protection (PIP) coverage. But the company's options to add to your policy can't match most major insurers.

In some cases, Direct Auto will not allow you to buy more than the minimum legally required amount of liability coverage, which severely limits the protection you can get from your policy.

The company also has a few other ways you can add to your policy.

Rental reimbursement

Pays for the cost of a rental car if the insured vehicle is inoperable after damage caused by a covered loss.

Towing

Reimburses the expenses for towing a broken-down car up to the limits the insured selects.

Accidental death coverage

Pays $5,000 to the insured's beneficiaries after death as a result of a covered accident.

Discounts with Direct Auto Insurance

Direct car insurance offers more than a dozen discounts to save on the cost of your policy. Several can help you save up to 25% off their policies.

- Safe driver discount: If you remain accident-free for at least three years, if you can save up to 10%.

- Good student discount: You can get up to 10% off a policy if you have at least a B average as a student in high school, college or vocational school.

- Senior citizen discount: If you complete an accident prevention course at 55 years old or older, you can save up to 5%.

- Driver education discount: Save up to 10% if you complete an accident prevention course or, if you are under 21, a state-approved drivers ed course.

- Multi-car discount: Cover more than one vehicle with Direct Auto and save up to 25%.

- Prior coverage discount: Rates can be reduced by up to 25% if you had your last insurer for nine months and have not had more than a 90-day lapse in coverage.

- Multi-product discount: You can reduce your policy by 5% if you bundle car insurance with life insurance. In some states, roadside assistance or an emergency protection plan could also qualify you for the discount.

- Multipolicy discount: You can save up to 10% if you have multiple policies with Direct Auto.

- Payment discounts: Setting up automatic payments, paperless billing or paying a policy in full can help save up to 9%.

- Homeowner discount: If you own the home where the insured vehicle is stored, you can save up to 15%.

- Welcome back discount: If you return to Direct Auto Insurance within six months of switching to another company, your bills could be reduced by up to 6%.

- Affinity discount: By being a member of an organization that's partnered with Direct Auto Insurance, you can see up to 9% in savings.

- Military discount: Save up to 25% if you are an active service member.

You can also enroll in Direct Auto's DynamicDrive program, a usage-based insurance program that monitors your driving. With good driving habits, you can save up to 10% on your insurance.

Comments

Post a Comment